By availing of the Cycle to Work benefit with Cyclescheme, you can get either a pedal bicycle and accessories up to the value of €1,250 or an e-bike and accessories up to the value of €1,500. You don’t pay Income Tax, PRSI or USC on the cost of your chosen bike package, so can save up to 52% on the retail cost

More Info Here

You can get 1 pedal bicycle/tricycle/pedelec (an electrically assisted bicycle which requires some effort on the part of the cyclist in order to effect propulsion). It will not cover motorbikes, scooters or mopeds or second hand bikes.

The following safety equipment is also covered by the exemption:

The Cycle to Work initiative gives you the opportunity to sacrifice part of your salary in return for one bicycle and/or allowable safety equipment, which should be used primarily for part or all journeys to/from work.

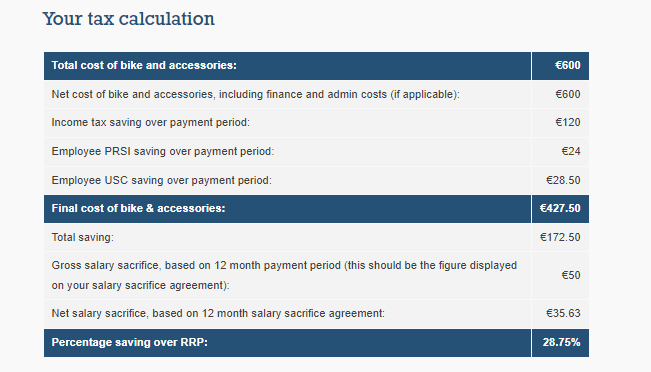

Under the scheme you don’t pay Income Tax, PRSI or Universal Social Charge on the price of a bicycle or eligible accessories

To take part in the Cycle to Work scheme your employer would need to be signed up to Cyclescheme Ireland

You can apply for 1 bike package and the limits are up to €1,250 for a pedal bicycle and eligible accessories and up to €1,500 for an e-bike and eligible accessories. You can only avail of the benefit and Tax savings once every 4 years.

You can save up to 52% on the retail cost - average savings range from 28.5-48.5% based on marginal tax rate (20% basic and 40% Higher,) USC @4.5% and PRSI @4%.

Employees can request a bike through the scheme once every 4 years.

You can see our terms and conditions here:

Yes. These schemes are not mutually exclusive.